1. Overview

FLOA is a Buy Now, Pay Later (BNPL) payment provider offering a diverse range of products tailored to meet the needs of both merchants and customers in the Western European market.

This guide is dedicated to the online payments implementation of FLOA BNPL.

BNPL Principle

After the payment is completed, the BNPL provider pays the full basket amount to the merchant and takes over the management of the installments and the related customer relationship.

2. Prerequisites

Before starting the integration, please ensure the following:

Your Market Pay contract include FLOA BNPL.

You have signed a contract with FLOA for BNPL services.

Your business activity and geographical location are eligible for FLOA services.

Your online payment setup supports the acceptance of FLOA payments.

To make sure your prerequisites are covered and/or for industries not described in this document, please contact your Market Pay account manager.

3. FLOA product offer supported by Market Pay

Market Pay currently covers FLOA in the following markets: France, Spain, Belgium, Italy, and Portugal. The product offer availability can vary according to the country.

OFFER | FRANCE | SPAIN | BELGIUM | ITALY | PORTUGAL |

|---|---|---|---|---|---|

3 x | AVAILABLE | AVAILABLE | AVAILABLE | AVAILABLE | Not available |

3 x interest free | AVAILABLE | AVAILABLE | AVAILABLE | AVAILABLE | AVAILABLE |

4 x | AVAILABLE | AVAILABLE | Not available | AVAILABLE | Not available |

4 x interest free | AVAILABLE | AVAILABLE | Not available | AVAILABLE | AVAILABLE |

10 x | AVAILABLE | Not available | Not available | Not available | Not available |

10 x interest free | AVAILABLE | Not available | Not available | Not available | Not available |

If the country and/or products you are looking for are not listed, please contact your Market Pay account manager for more information.

The table below gives the detailed description of each offer:

Product | Description | Country | Product code | Default range | Duration | Fees |

|---|---|---|---|---|---|---|

Payment in 3 times by CB | The customer pays his order in 3 installments, each 30 days apart. | FR | BC3XC | 50€ - 6000€ | 3 times (60 days) | Merchant and Customer |

SP | BC3XCES | 50€ - 2499€ | ||||

IT | BC3XCIT | 75€ - 6000€ | ||||

BE | BC3XCBE | 50€ - 6000€ | ||||

PT | NOT AVAILABLE | — | ||||

Payment in 3 times by CB - Free | The customer pays his order in 3 installments, each 30 days apart. | FR | BC3XF | 50€ - 6000€ | 3 times (60 days) | Merchant |

SP | BC3XFES | 50€ - 2499€ | ||||

IT | BC3XFIT | 75€ - 6000€ | ||||

BE | BC3XFBE | 50€ - 6000€ | ||||

PT | BC3XFPT | 50€ - 2500€ | ||||

Payment in 4 times by CB | The customer pays his order in 4 separate installments of 30 days each. | FR | BC4XC | 50€ - 6000€ | 4 times (90 days) | Merchant and Customer |

SP | BC4XCES | 50€ - 2499€ | ||||

IT | BC4XCIT | 75€ - 6000€ | ||||

BE | NOT AVAILABLE | — | ||||

PT | NOT AVAILABLE | — | ||||

Payment in 4 times by CB - Free | The customer pays his order in 4 separate installments of 30 days each. | FR | BC4XF | 50€ - 6000€ | 4 times (90 days) | Merchant |

SP | BC4XFES | 50€ - 2499€ | ||||

IT | BC4XFIT | 75€ - 6000€ | ||||

BE | NOT AVAILABLE | — | ||||

PT | BC4XFPT | 50€ - 2500€ | ||||

Payment in 10 times by CB | The customer pays his order in 10 installments, each 30 days apart. ⚠️ The customer will need to upload its ID during the customer journey | FR | BC10XC | 200€ - 3000€ | 10 times | Merchant and Customer |

SP | NOT AVAILABLE | — | ||||

IT | NOT AVAILABLE | — | ||||

BE | NOT AVAILABLE | — | ||||

PT | NOT AVAILABLE | — | ||||

Payment in 10 times by CB - Free | The customer pays his order in 10 installments, each 30 days apart. ⚠️ The customer will need to upload its ID during the customer journey | FR | BC10XF | 200€ - 3000€ | 10 times | Merchant |

SP | NOT AVAILABLE | — | ||||

IT | NOT AVAILABLE | — | ||||

BE | NOT AVAILABLE | — | ||||

PT | NOT AVAILABLE | — |

Refer to your FLOA contract to know which are your FLOA product and your applicable fee.

4. Customer journey

STEP 1

The customer selects items in merchant webstore and proceed to the check out.

STEP 2

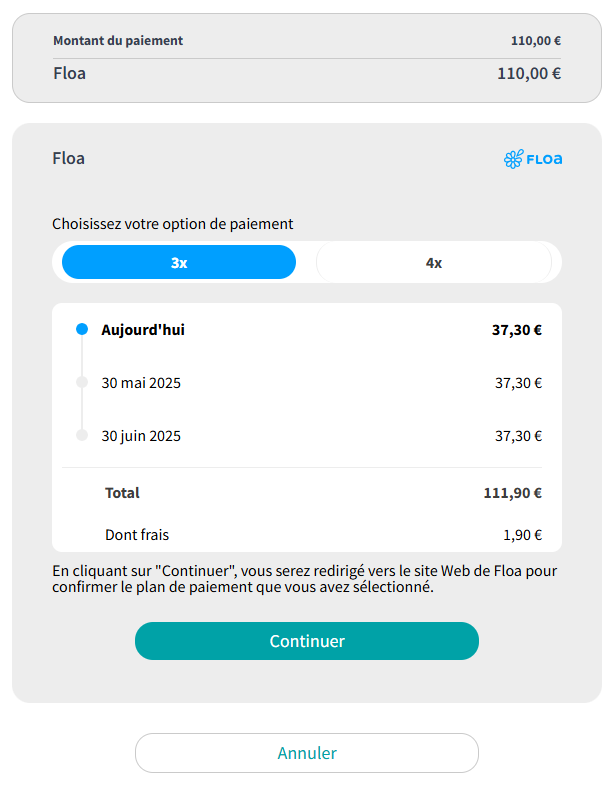

The customer selects FLOA and the installment plans simulation are displayed.

If the basket is not eligible for FLOA payment, no payment plan will be presented. The payment attempt will be rejected, and the customer will be asked to select another payment method.

To prevent this friction in the customer journey, we recommend that the merchant checks the eligibility of the basket for FLOA payment. The FLOA method should be called only if the basket meets the prerequisites.

STEP 3

The customer selects the payment installment plan and clicks on “Continue”. The customer is redirected to FLOA website to complete the payment.

STEP 4

Once the payment completed, the customer is redirected to the merchant webstore. The purchase is confirmed.

STEP 5

Payment is triggered by FLOA according to the payment installment plan.

5. Onboarding

You will need to sign an agreement with FLOA. You will have to provide your KYC documents, and your agreement will define which products are eligible for your business.

FLOA will provide you with a FLOA KEY that needs to be shared with Market Pay. This key will be used to secure the merchant’s FLOA payments. There is one FLOA KEY per company activity, regardless of the number of points of sale.

NEXT STEPS

See Integrating FLOA for enabling FLOA on your checkout page.